John M Lund Photography Inc

There is no doubt that the S&P 500 (SPX) returns have been fantastic with investors enjoying nearly 30% gains in the last year.

S&P Global Market Intelligence

It has been a multi-year success story with approx. 15% CAGR over the last 5 years.

Will it continue? Is it still a good place to park investment dollars?

We think the answer is no. A significant portion of the S&P’s recent gains have come from multiple expansions, and valuations are showing some serious warning signs.

This article will examine valuation from a variety of angles in an attempt to hone in on forward-looking expected returns. Let’s start with the broad view and then get into the numbers.

Broad view of the S&P 500

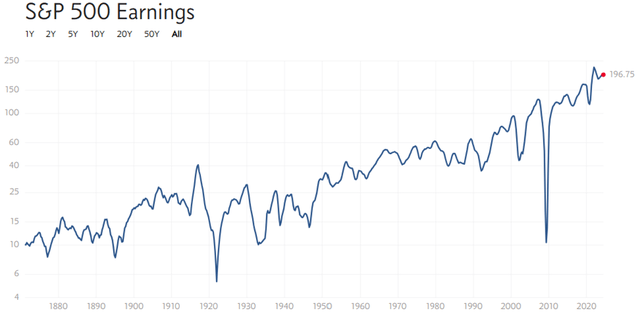

The S&P 500 is roughly a reflection of the US economy. For very long periods, the US has had the best economy in the world, and this is reflected in robust earnings growth for the S&P 500.

Multpl.com – earnings go to June 2024

Consensus estimates call for fundamental growth to continue through 2025 and beyond. I largely agree, as the US economy generally appears to be growing nicely.

The problem from an investment standpoint, however, is that capital gains have dramatically outpaced earnings growth. Below is the price of the S&P 500 during the same period as the earnings above.

Multpl.com – earnings go to June 2024

It can be hard to tell because the Y-axis in both graphs is logarithmic, but the slope of the price graph is much steeper than the slope of the earnings graph.

Since 1872, S&P 500 earnings have increased 20.2X, but during the same period the market price increased 1241.7X.

An interesting factoid, but perhaps skewed due to the nascent market back in 1872.

Instead, let’s look at a more modern and normal time in the market starting in January 2011.

S&P trailing earnings were 111.34 and the S&P 500 was priced at 1,282. Current estimates for 2024 earnings are 211.67 and the S&P is priced at 6,039 at the end of December 26, 2024.

So while earnings are up about 90%, the price is up 371%.

Data from Multpl.com and FactSet per 24/12/24. Calculations by 2MC

That takes the subsequent multiple to a whopping 28.5X

Historically, the S&P 500 has traded at a median multiple of 15.04X (source Multipl – Market, financial and economic data).

That’s a pretty high valuation, and most analysts agree that the S&P valuation is currently high.

Opinions are divided as to whether it is too high. We believe that this is too high and that future returns will suffer as a result.

Cycle-adjusted analysis

Earnings are strong and earnings growth projections for 2025 are strong, which some suggest justifies the high multiple. The FactSet consensus calls for 14.8% growth by 2025, and 28.5X earnings would be a fair valuation if we were to extrapolate this growth rate far into the future.

Given the prices, it appears that this is what the market is doing.

However, the S&P, like the economy, is quite cyclical. It has times of excellent growth and times of negative growth, so I think it’s a bit aggressive to just cross out the good times.

In fact, one could argue that the S&P is currently outperforming its potential. Net profit is expected to be 12% in 2024 and 13% in 2025.

Fact set

These numbers are well above historical norms and may be subject to significant regression.

Net profit tends to track towards the mid-to-high single digits due to free market forces.

- When profit margins are too low, companies will dissolve, allowing the remaining companies to gain market share and increase profit margins

- When profit margins are too high, new firms will be encouraged to enter, increasing competition and lowering profit margins.

A forecast that margins will remain unusually high in perpetuity suggests that something has changed profoundly in bringing market forces into balance. There have been significant productivity gains, which may be the source of higher margins, but without break-even mechanisms, I see no reason why it wouldn’t just filter through to lower prices. I have not seen a convincing case for permanently high margins and believe they will still be subject to a bad return as they have been in the past.

Because of cyclicality and the mean reversion of margins, I think Robert Shiller was right in looking at valuation from a cyclically adjusted point of view. Shiller created the CAPE ratio, or cyclically adjusted price-to-earnings ratio, which is an average of earnings over the previous 10 years. The Shiller P/E also adjusts for inflation, which is especially relevant today given the recent struggle.

On this metric, the S&P’s valuation is extraordinarily high.

Multipl.com

With a Shiller P/E of 38.35X, the S&P has only been higher once, approaching that level at a peak back in 1929. Thus, today’s valuation is most reminiscent of the dot com bubble or just before the Great Depression.

Multpl.com as of 12/24/24 added annotations

Each of these would have been terrible times to invest in the S&P 500.

In the following section, we will examine how the valuation affects future expected returns.

Shiller P/E as an indicator of forward return

Invesco released one great research piece on the predictive power of the Shiller P/E. In it, they map forward returns against the Shiller P/E for the S&P 500.

Invesco

As we discussed before, the market has changed since its inception, so Invesco redid the graph for more modern times (since 1983).

Invesco

Source: Invesco

In each graph, the right axis is inverted to show how strong the correlation between the Shiller P/E and forward returns is.

When we notice that it is inverted, we should conclude that it is a negative correlation.

In other words, the higher the Shiller P/E at any given time, the lower the forward return for the S&P 500. Since this is historical data on forward 10-year returns, of course the light blue line ends 10 years ago.

GuruFocus used this and other data to estimate forward returns based on the Shiller P/E going up to the present (or rather November 2024, when their graph was made).

GuruFocus

The latest data point on the chart above is November 1, 2024, which equates to an implied forward return of 1.9%.

This is of course hypothetical and is just the implication if the historical trends in the Shiller P/E hold true. As such, I wouldn’t take this as a hard 1.9% data point, but rather as a ball game.

The logic checks out. Since the earnings multiple is so high, the cash flows are really low relative to each dollar invested. I find the extremely high valuation of the S&P particularly puzzling given the rise in 10-year Treasury yields.

S&P Global Market Intelligence per 24/12/24

Total take

While S&P earnings have been strong, price increases have far outpaced earnings growth, so valuations have become extremely high. From these highs, we expect the S&P’s forward performance to be significantly lower, likely in the low single digits on average for the next 10 years.

Note that when valuations were extreme around 2000, the forward 10-year return on the S&P was approx. 0% It is now known as the lost decade. Valuations aren’t quite as extreme today, so we think low single digits (perhaps 3%-5% CAGR) is the more likely outcome.

Editor’s Note: This article covers one or more microcap stocks. Be aware of the risks associated with these stocks.